Choices To Purchase

Choices To Purchase

Blog Article

Overview

The Housing and Development Board (HDB) is Singapore's public housing authority, to blame for furnishing affordable housing choices to its citizens. 1 well-known means of possessing an HDB flat is with the use of an Option to invest in (OTP). An OTP is usually a lawful doc that grants the client the unique correct to purchase a selected HDB flat in just a specified period of time.

Goal of an OTP

An OTP serves quite a few uses in the entire process of getting an HDB flat:

Unique Right: By getting an OTP, the client ensures that no other individual should purchase the particular HDB flat through the validity period said in the option.

Time for Conclusion-Generating: The validity time period will allow enough time for purchasers To judge their fiscal scenario, evaluate eligibility and suitability, and seek out information ahead of committing to buy.

Overall flexibility: The buyer has adaptability during the validity period of time as they can come to a decision whether or not to work out their alternative dependant on modifying instances including financial loan approval or preferential spot tender results.

Measures Linked to Obtaining an OTP

To obtain an OTP for obtaining an HDB flat, several methods should be adopted:

Pick a Flat: Make a decision on the specified locale, kind, measurement, and rate selection of your chosen HDB flat.

Test Eligibility: Make sure that you satisfy all eligibility standards established by HDB about citizenship status, family members nucleus composition, age demands, profits ceiling restrictions, etc.

Apply for Mortgage Approval In Principle (AIP): It is important to make an application for AIP from financial institutions or fiscal establishments in advance of implementing for an OTP as this can help establish your greatest financial loan total based upon your economical potential.

Post Application for Oct & Await Benefits: Soon after getting AIP approval from banks/financial establishments; post on the internet application via e-Services portal called "Gross sales Start".

Get Supplying Letter: Should your application is thriving, you might get an supplying letter from HDB with Guidance on how to guide an appointment and proceed to acquire the OTP.

E-book Appointment & Total Scheduling of Flat: Ebook an appointment at a specified HDB Hub department to finish the necessary paperwork, make payments, and accumulate the OTP document.

Vital Stipulations in an OTP

When acquiring an OTP for acquiring an HDB flat, there are many vital stipulations outlined within the doc:

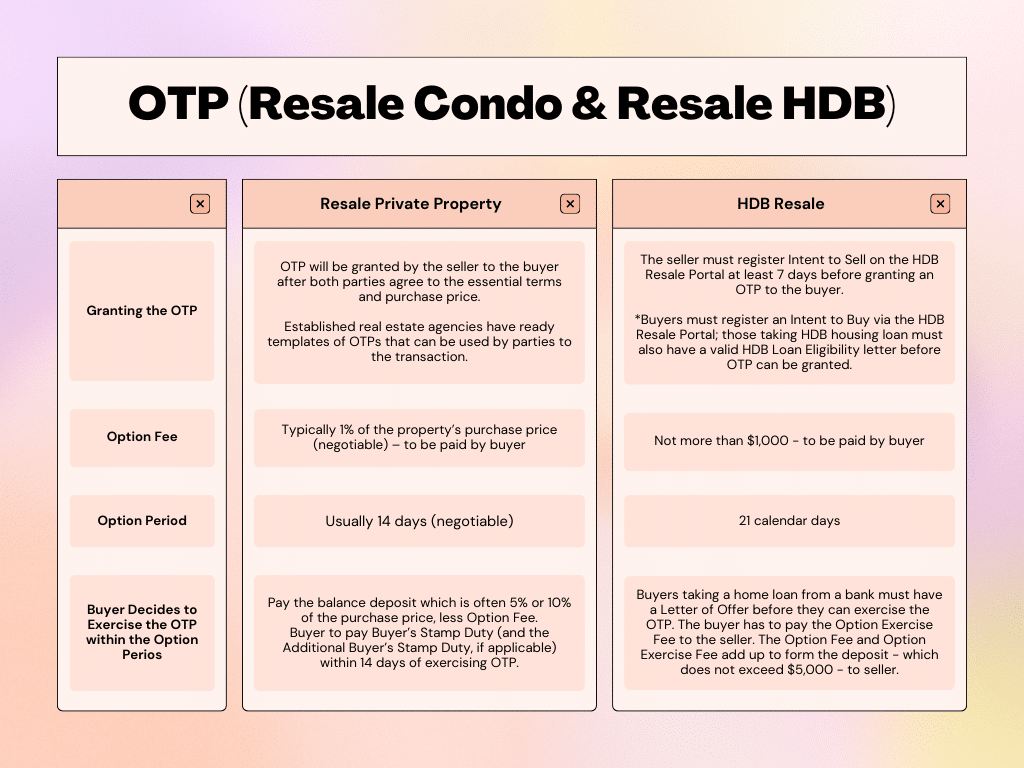

Validity Period: The period of time inside of which the customer can make a decision if to exercising their option and progress with the purchase.

Acquire Rate: The agreed-upon selling price in between the client and vendor for your HDB flat.

Possibility Payment: A partial payment produced by the buyer as thought for getting unique rights less than the option.

Exercising Fee: An extra cost payable by the buyer when working out their solution to purchase inside the validity period of time.

Exercising or Letting Go of a choice

In the validity interval stated inside the OTP, prospective buyers have two solutions:

Working out Selection:

Spending any equilibrium downpayment expected (ordinarily 20% of buy value).

Confirming financing arrangements by using a financial institution or money establishment.

Amassing check here keys to new flat on completion of all lawful procedures.

Continuing In keeping with HDB's guidelines for resale flats or Develop-to-Order (BTO) flats.

Letting Go of Choice:

Forfeiting any charges paid in the course of booking: choice charge, workout payment, and so on.

Enabling Other individuals enthusiastic about getting that specific HDB flat in the course of remaining revenue launch/software intervals.

It is necessary for prospective consumers to be aware that failing to exercise their possibility by not completing requisite steps in its validity time period might cause them to shed the option fees forfeit in its entirety.

Summary

The Option to Purchase (OTP) is a significant document in the whole process of obtaining an HDB flat. It provides buyers with exceptional rights, time for decision-building, and flexibility before confirming their invest in. Knowing the steps included, important conditions and terms, and achievable results when doing exercises or permitting go of a choice is crucial for individuals considering HDB possession.